From Capex to MaaS: The OEM’s Guide to Recurring Revenue Transformation

From Capex to MaaS: The OEM’s Guide to Recurring Revenue Transformation

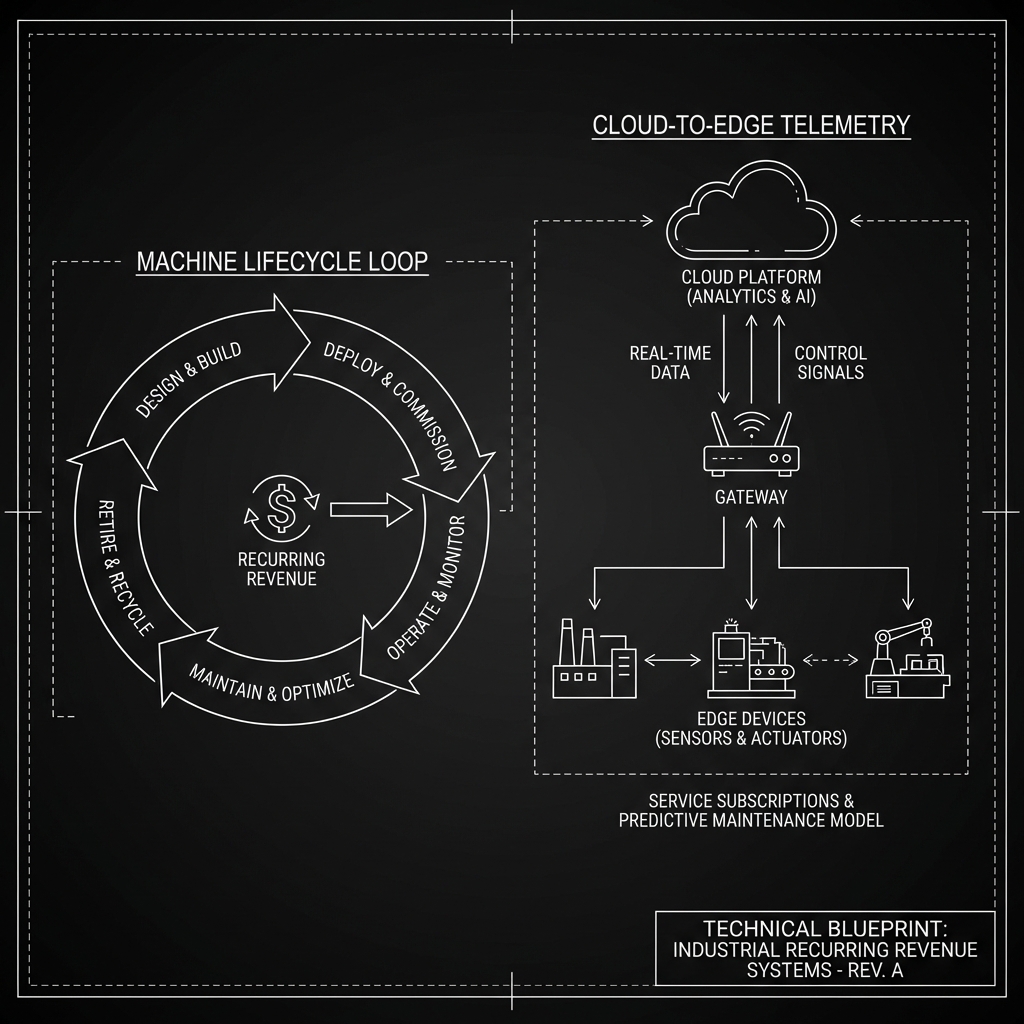

The mechanical engineering and digital infrastructure required to successfully pivot from selling iron to selling outcome-based contracts.

For the better part of a century, the Industrial Original Equipment Manufacturer (OEM) has operated on a simple, comforting, and high-capital business model: Design a machine, manufacture it, sell it for a significant upfront capital outlay (Capex), and then—if you're lucky—capture 10% to 15% of that machine's lifetime value through spare parts sales and occasional service visits.

Success was measured in units shipped. Operational risk was the customer's problem. Once the machine left the factory dock, its performance, its downtime, and its ultimate "Yield" were no longer the OEM's primary financial concerns.

But the world has changed. Today's industrial customers are facing extreme capital constraints, labor shortages, and an urgent need for agility. They no longer want to "own" a machine; they want to "consume" a result. This is driving a massive industry-wide pivot toward Machine-as-a-Service (MaaS)—an outcome-based model where the customer pays for a metric (e.g., liters of fluid bottled, hours of uptime, or number of defect-free components produced) rather than the iron itself.

// DATA_SOURCE: OEM BUSINESS TRANSFORMATION INDEX // 2025

For the OEM, MaaS is the ultimate margin opportunity and the path to a 3x higher enterprise value multiple. However, this transformation is not a "Sales" project; it is a fundamental rewriting of the machine’s Technical DNA.

The Risk-Margin Exchange

"In MaaS, you aren't selling iron; you are selling uptime. Every hour of downtime is a direct hit to your P&L, necessitating a move to proactive reliability."

The MaaS Paradox: When Downtime Becomes YOUR Cost

The transition from Capex to MaaS creates a radical shift in financial incentives that most OEMs are unprepared for. In the traditional model, a machine breakdown is actually an "opportunity" for the OEM to make high-margin revenue on expedited spare parts and emergency technician labor.

In a MaaS model, the machine's breakdown is the OEM's loss. If the contract is "Pay-per-Output," every second that machine isn't running is a second of lost revenue. If you are responsible for the uptime, your service technician's travel time is now a direct cost to your P&L, not a billable line item to the client.

This "MaaS Paradox" forces the OEM to transition from a manufacturer into a high-tech service operator. To survive this shift, your engineering team must build for three critical technical capabilities.

The Liability Pivot

"Under MaaS, a service call is an overhead cost, not a invoiceable event. Your engineering KPIs must shift from 'Initial Build Cost' to 'Mean Time Between Failure (MTBF)'."

Pillar 1: Predictive Reliability and the "Self-Diagnostic" Machine

A MaaS-ready machine must be its own best mechanic. It must be designed with an "Intelligence Layer" that goes far beyond simple sensor thresholds (e.g., "Alert if temperature > 80C").

You must build high-frequency telemetry into the core of the mechanical design. We are seeing OEMs achieve significant success by integrating:

- Vibration Analysis: Identifying bearing wear weeks before catastrophic failure.

- Acoustic Emission Monitoring: Detecting the "sound" of microscopic stress in critical structural components.

- Power Signature Analysis: Using the motor's current draw to detect mechanical friction or process drift.

In a MaaS model, the machine doesn't just "report an error." It uses edge-processing to say: "I am predicting a 90% chance of a drive-belt failure within the next 72 hours. Please schedule a 15-minute maintenance window at 4:00 AM on Thursday to maintain uptime."

Pillar 2: The Secure Fleet Orchestration Layer (OTA)

You cannot run a high-margin MaaS business if you have to send a technician with a laptop every time you want to update the machine's control logic or improve its efficiency.

Successful MaaS transformation requires a robust Over-the-Air (OTA) Orchestration Layer. This allows you to treat your global fleet of thousands of machines like a distributed data center.

- Performance Optimization: You can remotely push new process parameters to a machine in Brazil based on a successful optimization you discovered at a similar machine in Germany.

- Security at Scale: You can patch cybersecurity vulnerabilities across your entire fleet in minutes, not months.

- Feature Tiering: MaaS allows you to "unlock" high-speed modes or advanced analytics features remotely as part of a premium service tier, without changing the physical hardware.

Pillar 3: The "Digital Birth Certificate" (Closed-Loop PLM)

To sell outcomes, you must have total transparency into the machine’s lifecycle. You need a single source of truth that links:

- The Physical Twin: The exact CAD model, bill of materials, and firmware version of that specific serial number.

- The Digital Twin: The real-time sensor data and operational history of the asset.

- The Financial Twin: The specific outcome-based contract, the SLA (Service Level Agreement) terms, and the real-time billing status.

Without this "Closed-Loop" link, your service team won't know which parts to bring to a site, your finance team won't know how much to bill, and your engineering team won't know why the machine is failing in the real world.

The Economic Transformation: Why the Effort is Worth It

While the technical hurdle is high, the payoff for OEMs is generational.

1. Generational Customer Lock-in

In a Capex world, your customer "goes out to bid" Every five years for the next machine. In a MaaS world, you are a critical part of their operational flow. You own the outcome. The cost for the customer to "switch iron" when you are already delivering their desired results is massive.

2. Recession-Proof Revenue

Capital budgets are the first thing cut in a downturn. Operational budgets (Opex) are the last. A MaaS OEM has a steady, predictable "Recuring Revenue" stream that investors value significantly higher than "volatile" one-time gear sales.

3. R&D Powered by Reality

Instead of relying on anecdotal feedback from the field, your R&D team now has millions of hours of real-world operational data. You know exactly which components fail first, which process setpoints are most efficient, and how customers are actually using your machines. This creates a "flywheel" effect where each generation of your MaaS iron becomes exponentially better than the competitors'.

The LOCHS RIGEL Execution Roadmap

Phase 1: The "Digital Wrapper" Pilot Don't start by redesigning your entire product line. Start by building a retrofittable "Edge Gateway" that can pull data from your existing machines in the field. Use this to build your predictive models and prove the "Uptime" case to your customers.

Phase 2: Incentivize the Engineers Change your internal KPIs. Stop rewarding engineers for "Manufacturing Cost Reductions" and start rewarding them for "Total Cost of Ownership (TCO) per Operational Hour." A part that is $5 cheaper to make but fails 2x as often is a disaster in a MaaS model.

Phase 3: Pivot the Sales Motion Moving from a "Price of Iron" sale to an "Outcome Agreement" requires a different kind of salesperson. They must understand the customer's P&L as well as they understand the machine's RPMs.

The Walkaway

The MaaS transition is not a software project; it is a profound transformation of what it means to be an Industrial OEM. It requires mechanical engineers to think like software developers, service teams to think like reliability engineers, and sales teams to think like financial analysts.

At LOCHS RIGEL, we provide the technical architecture and the operational Playbook to make this pivot profitable. We help you build the "Nervous System" that turns your machines from passive assets into self-optimizing outcome engines.

The future of industrial equipment isn't just iron—it's intelligence, delivered as a service. Are you selling iron, or are you selling results?